YIJ 03: A Young Investor’s Deep Dive — How Does McDonald’s Really Make Money?

The Golden Arches Under the Monocle

Welcome back to Young Investor Journey! Our first step in analyzing any company is to understand what it is and how it actually makes money. For a giant like McDonald’s — a company we all think we know — there’s a surprisingly complex engine working behind the scenes.

The company’s investor relations page is a treasure trove of annual reports, quarterly updates and fact sheets. With the help of the powerful combination of AI assistance to process the data and our human mentor, Reginald, to guide and challenge us, I’ve dug in to answer the big questions.

First — What is McDonald’s?

We’ve all been there: you walk in, place your order and get your food in record time. McDonald’s didn’t just join the fast-food world; it pioneered the Quick Service Restaurant (QSR) model as we know it today.

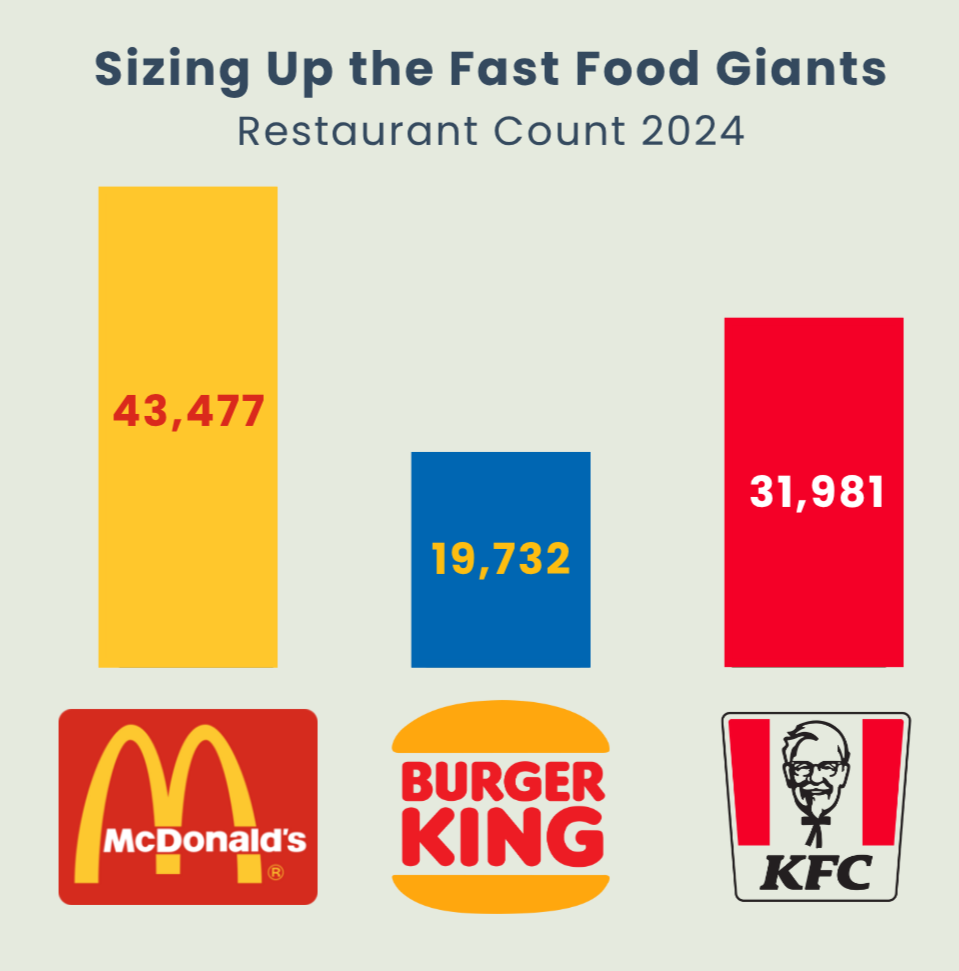

An American icon with a history spanning over 85 years, its Golden Arches are instantly recognizable worldwide. It isn’t just a logo; it’s a statement of global market leadership. As of the end of 2024, McDonald’s is the largest QSR chain on the planet, with an incredible 43,477 restaurants.

Second — How McDonald’s Actually Make Its Money

This is where it gets interesting for us as investors. McDonald’s has two very different, but related, headline numbers: Corporate Revenue and Systemwide Sales.

In 2024, McDonald’s Corporate Revenue was $25.9 billion. This is the money the company actually records as sales and is generated in two main ways:

Company-Operated Restaurants:

McDonald’s directly operates a small fraction of its stores (~5%). These brought in $9.8 billion in 2024. This is the most obvious revenue stream — they sell burgers and fries and they keep the sales revenue. After paying for expenses of operating the stores, this generated $1.4 billion in restaurant profit.

Franchised Restaurants:

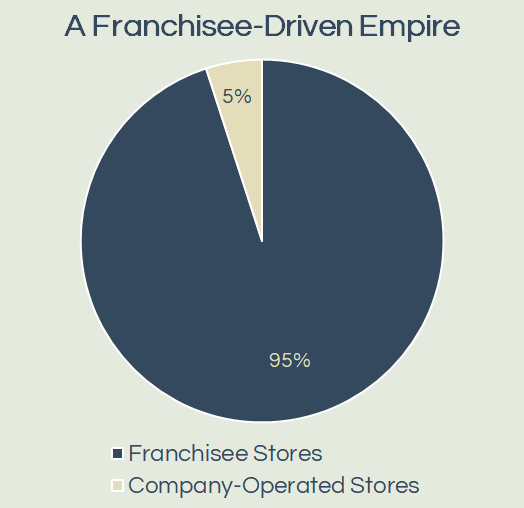

Here lies the true engine of the business. A staggering 95% of McDonald’s restaurants are run by franchisees. This model is brilliant because it provides steady, high-margin income streams.

Royalties and Fees: Franchisees pay an initial fee of $45,000 per restaurant and ongoing royalties, which are approximately 4-5% of their sales, to use the brand and system. This provides McDonald’s with a very profitable, low-overhead income.

Real Estate Empire: This is the secret sauce. McDonald’s owns the buildings for ~78% of its conventional franchised restaurants. These sites are then leased out to franchisees who pay rent regardless of sales performance. This generates a significant and stable source of rental income. Furthermore, McDonald’s has first dibs on prime locations.

McDonald’s Secret Sauce: A Real Estate Empire?

From these franchise-based streams, McDonald’s received $15.7 billion in 2024. As the associated costs are so low, this generated a massive $13.2 billion in profit. This is where the secret sauce is revealed. The real business isn’t selling burgers, it’s being a landlord. The majority ($7.6 billion) of that staggering profit comes from rent. To see how this really works, we can break down their entire profit model into a simple framework I call “Burgers, Branding and Buildings.”

Burgers: The profit from the restaurants they run themselves.

Branding: The high-margin profit from royalties and fees.

Buildings: The stable, powerful profit from real estate rent.

So, what about the huge numbers you see in the news? That’s systemwide sales. This is the total sales generated by all McDonald’s restaurants, both company-operated and franchised.

In 2024, this figure was a mind-boggling $130.7 billion.

To put that in perspective, if the McDonald’s system were a country, its economic activity would be larger than the entire GDP of many countries, like the Dominican Republic, Ecuador and Oman!

SWOT Analysis: A Deeper Look

Now that we understand the business model, let’s evaluate the company. A SWOT analysis is the perfect tool to map out its internal Strengths and Weaknesses against its external Opportunities and Threats.

Strengths

Iconic Brand Value: From the Golden Arches to the “i’m lovin’ it” slogan, McDonald’s is a cultural phenomenon. This brand power translates to strong customer loyalty and a dominant market position.

Powerful Franchise Network: With over 43,477 restaurants at the end of 2024, McDonald’s dwarfs its competition (Burger King has 19,732 stores and KFC has 31,981). This massive scale provides a large, reliable base of royalty payments and creates immense purchasing power, driving down costs.

Real Estate Portfolio: Owning the majority of its restaurant buildings provides a stable, high-margin income from rent, insulating the company from the daily volatility of the fast-food business.

Unmatched Global Presence: With 69% of its restaurants operated outside the US and in over 100 countries, McDonald’s successfully blends its core menu (Big Mac and Happy Meals) with local favorites (like the McSpicy here in Singapore!), demonstrating a unique ability to adapt to diverse tastes.

Embracing Technology: From self-service kiosks and McDelivery to the MyMcDonald’s Rewards loyalty program, the company invests heavily in technology to improve customer experience. Those loyalty points are a clever way to promote treats — it’s certainly my favorite way to cash in for a McFlurry!

Weaknesses

Labor Challenges: Like much of the QSR industry, McDonald’s faces high employee turnover, often linked to less competitive wages and poor work perception. This can impact service consistency and operational efficiency, although this is partly mitigated by a simplified and standardized workflow.

Menu Complexity: A vast and sometimes bloated menu can overwhelm customers and complicate kitchen operations, potentially slowing down that “quick service” promise.

Opportunities

Expansion in Developing Markets: While already a giant with 29,920 stores overseas, McDonald’s still has room to grow in underpenetrated and rapidly developing economies. Between 2022 and 2024, the company has seen a 3,089 outlet increase overseas.

Digital Transformation: The company continues to invest heavily in technology, with a focus on integrating AI and digital platforms to personalize the customer experience, drive loyalty and streamline operations.

Healthier Options: As global tastes shift towards healthier eating, McDonald’s can capture a wider audience by expanding its health-conscious choices, such as its sub-500 calories options, plant-based meals or healthier drink options.

Threats

Intense Competition: The QSR market is saturated. McDonald’s faces constant pressure from traditional burger rivals like Burger King and alternatives like Subway and KFC, all fighting for the same customers.

Negative Health Perception: The global trend towards healthier eating is a significant long-term challenge. The association of fast-food with health problems, such as diabetes and obesity, is a persistent threat to the brand’s image.

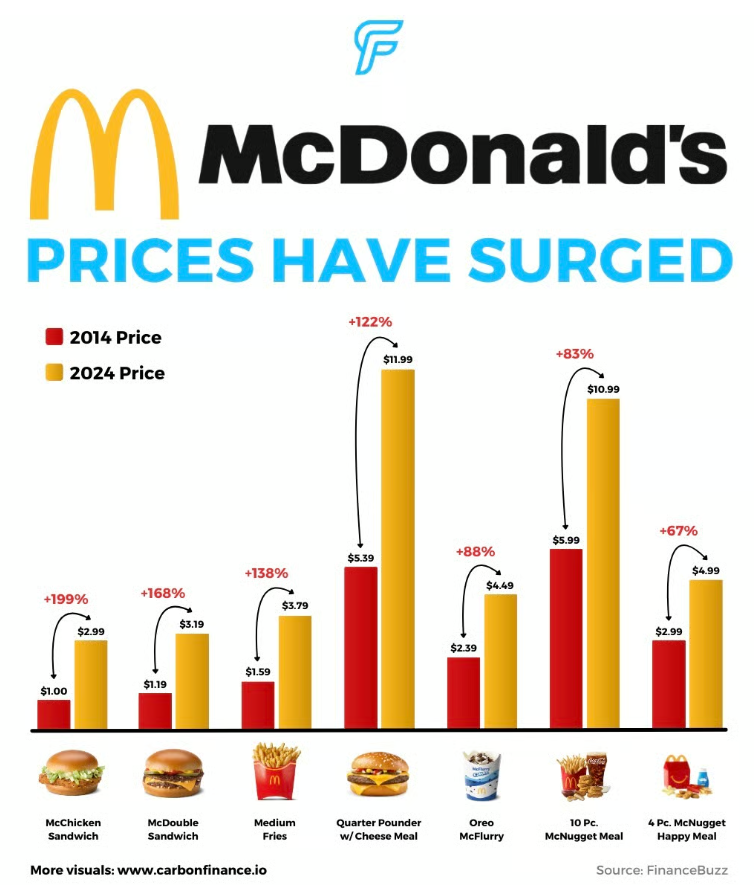

Economic Factors: Rising ingredient and labor costs have led to higher menu prices (menu prices increased significantly, over 100% during the last decade). This can tarnish McDonald’s reputation for affordability and price out lower income consumers.

Ethical and PR Controversies: As a global brand, McDonald’s is under constant scrutiny. Controversies, such as the boycotts related to the conflict in Gaza, can quickly impact regional sales and damage brand perception.

Conclusion

This analysis gives us a solid framework. We see a powerful, resilient company with a brilliant business model, but one that is not without its challenges.

This context is crucial as we move forward. In our next post, we’ll use Porter’s 5 Forces to dive deeper into the competitive landscape McDonald’s navigates.

To make sure you don’t miss it, subscribe to our newsletter and get the next post delivered straight to your inbox!

Going Straight to the Source

As Reginald always reminds us, the first step in any analysis is getting good data. For this deep dive, we pulled all financial data and restaurant counts directly from the official investor relations websites and annual reports of McDonald’s Corporation, Yum! Brands (for KFC) and Restaurant Brands International (for Burger King). This is a crucial habit for any young investor and one we’ll stick to on our journey.

Let’s keep growing together 🌱

— Nicholas

Watch this in action on Instagram!